09 February 2022

8 min read

Published by:

Two landmark decisions handed down today have revised the approach to determine whether a worker is an independent contractor or employee.

In the decision of Construction, Forestry, Maritime, Mining and Energy Union & Anor v. Personnel Contracting Pty Ltd [2022] HCA 1 (CFMMEU v Personnel Contracting) and ZG Operations Australia Pty Ltd & Anor v. Jamsek & Ors [2022] HCA 2 (ZG v Jamsek) (together, High Court Decisions), the High Court upheld the primacy of the terms of the written agreement as a key factor in establishing the legal character of the relationship.

The High Court Decisions are significant because the Court has found where parties have entered into a valid and comprehensive written agreement, the ultimate characterisation of the relationship is focused on rights and duties established by the written contract, rather than how the relationship operates in practice. Where the terms of the written agreement are not in dispute, an expansive enquiry into the ‘substance and reality’ of the relationship is not required.

The High Court Decisions indicate a shift to the primacy of the contract rather than the multi-factor test moving forward.

As explored in our previous article, ‘When a duck is not a duck: Differentiating contractors from employees’, the previous and well-established legal test for determining if a contractor is an employee is the ‘multi-factor test’.

The question of whether a worker is an independent contractor or an employee can be complex. The courts have previously held that even the existence of a valid independent contractor agreement, where the parties proceeded in accordance with the terms of the agreement, did not automatically result in a finding that the worker was an independent contractor.

The multi-factor test considers all relevant factors to determine whether a person is an employee or an independent contractor. Each case is determined on a case-by-case basis. The factors considered often include, but are not limited to:

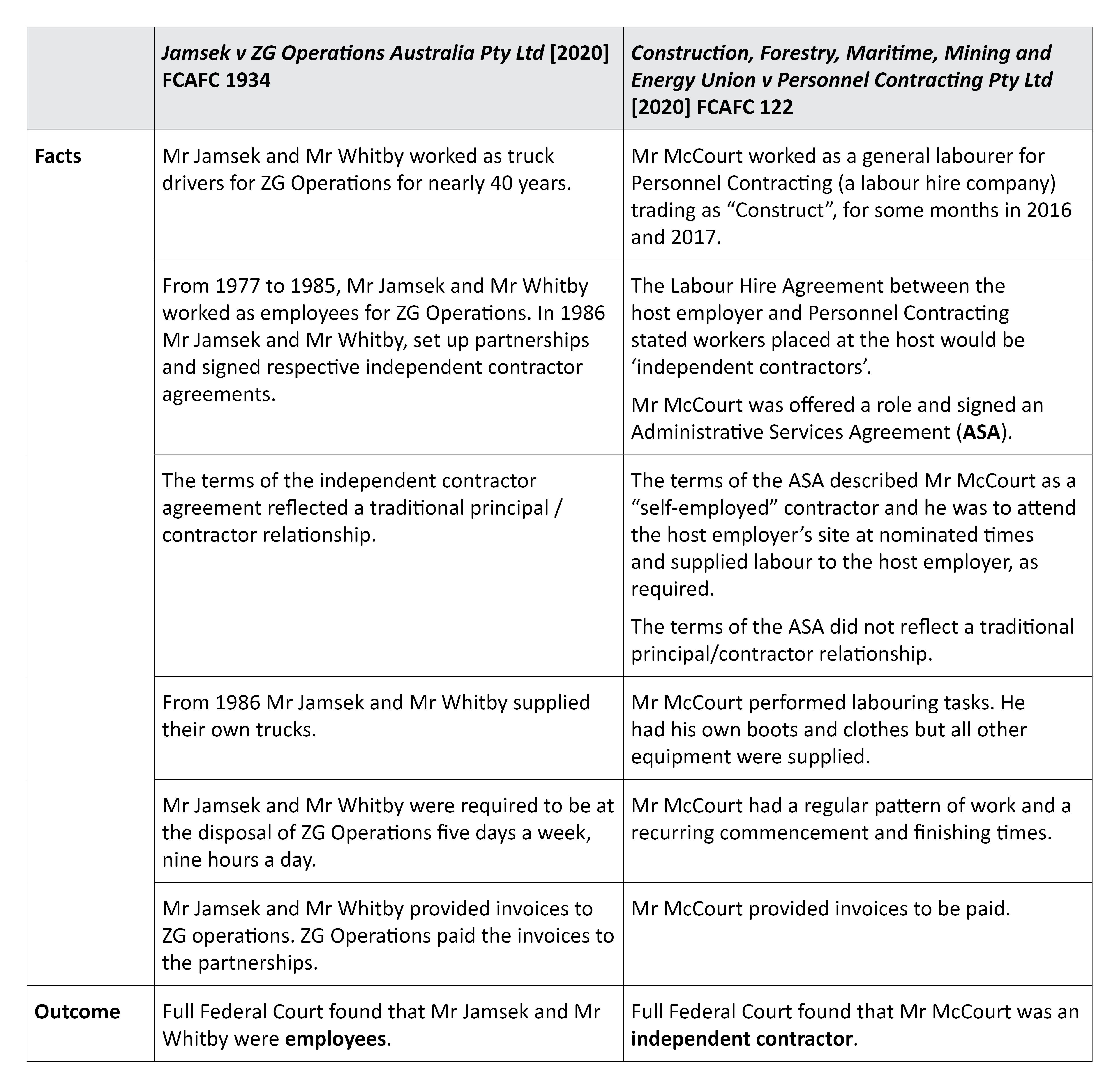

The High Court Decisions were appealed from two previous decisions by the Full Federal Court. In both cases, the Full Federal Court applied the multi-factor tests and came to different outcomes.

We summarise key background of the two cases in the table below.

In Construction, Forestry, Maritime, Mining and Energy Union v Personnel Contracting Pty Ltd [2020] FCAFC 122, the Court found that because of the labour hire relationship, establishing the element of “control” between Personnel Contracting and Mr McCourt was placed in fundamental tension and could not be overcome.

The CFMMEU appealed the decision on, among other things, that the Full Court wrongly applied the assessment of control.

In Jamsek v ZG Operations Australia Pty Ltd [2020] FCAFC 1934, the Full Federal Court found that they were employees because ZG Operations exercised a high level of control over Mr Jamsek and Mr Whitby. Factors that led to this conclusion, included among other things, the contracts required Mr Jamsek and Mr Whitby to be at the disposal of the business nine hours a day, five days a week, and the long and uninterrupted working relationship.

ZG Operations appealed this decision to the High Court on the ground that the Full Court erred by holding that Mr Jamsek and Mr Whitby were employees.

The High Court overturned both of the Full Federal Court decisions. In CFMMEU v Personnel Contracting, it was found that Mr McCourt was an employee and in ZG v Jamsek, it was found that Mr Jamsek and Mr Whitby were independent contractors.

The High Court Decisions placed a strong emphasis on the written agreement in determining the legal character of the relationship. If the rights and obligations of the parties in that agreement point to an independent contractor relationship, and the agreement is not rendered ineffective because of a sham or illegality, then the legal character of the relationship is not affected by the way the agreement operates. In CFMMEU v Personnel Contracting, the majority of the High Court held, at [59]:

“Where the parties have comprehensively committed the terms of their relationship to a written contract the validity of which is not in dispute, the characterisation of their relationship as one of employment or otherwise proceeds by reference to the rights and obligations of the parties under that contract. Where no party seeks to challenge the efficacy of the contract as the charter of the parties' rights and duties, on the basis that it is either a sham or otherwise ineffective under the general law or statute, there is no occasion to seek to determine the character of the parties' relationship by a wide-ranging review of the entire history of the parties' dealings. Such a review is neither necessary nor appropriate because the task of the court is to enforce the parties' rights and obligations, not to form a view as to what a fair adjustment of the parties' rights might require”

The High Court applied the above principles to each case.

In CFMMEU v Personnel Contracting, the Court determined that Mr McCourt had been provided with the ‘label’ of independent contractor. Mr McCourt was not carrying on his own business, rather he was required under the ASA to work as directed by Personnel Contracting or its customer. The effect of the rights and duties created by the ASA was that Mr McCourt was employed by Personnel Contracting as an employee.

Similar to an employment contract, Mr McCourt (under the ASA) was required to follow the direction of Personnel Contracting or one of their customers, and they retained the right of control over Mr McCourt. The terms of the written agreement were the determinative factor in finding that Mr McCourt was not an independent contractor.

In ZG v Jamsek, neither party of the proceedings brought the validity of the agreements into question. Accordingly, the Court found that the independent contractor agreement was valid and determined the legal character of the relationship.

The Court considered the context in which the first independent agreement was entered into. Mr Jamsek and Mr Whitby had previously been employees and had agreed to independently set up partnerships and purchase their own trucks to continue to work in a principal/contractor relationship.

The High Court Decisions did not specifically address what approach would be taken in the absence of a written agreement and how the multi-factorial test should be applied in these circumstances.

Miscategorising an employee as an independent contractor can have significant legal and commercial implications for an organisation.

While the High Court Decisions provide greater certainty for those engaging independent contractors, it is still important to ensure the contractor agreement is adequately drafted and implemented effectively.

As such, we recommend organisations consider taking the following steps:

1. Ensure each engagement of an independent contractor is confirmed in a written agreement

In light of today’s decision, it is important that all independent contractors are engaged according to a written agreement, with terms that accurately reflect a principal/contractor relationship. In the absence of a written agreement, organisations are exposed to a finding of employment.

A written agreement for a contractor should clearly define the nature of the relationship and the terms and conditions of the relationship, including payment, termination and services to be provided.

Organisations should also consider the utility of obligations of the independent contractor in relation to confidential information, intellectual property and restraints of trade.

2. Review template independent contractor agreements

Organisations should review current written agreements with independent contractors to ensure that the terms of the agreement reflect the principal/contractor relationship. For example, contractor agreement should not include any entitlements such as annual leave.

As above, it would be prudent for companies to ensure all precedents for on-boarding are up to date and accurately reflect the principal/contractor relationship.

3. Review current engagements

Organisations should review current engagements and written agreements to ensure independent contractors have not been provided with a ‘label’ where the duties and obligations reflect an employment.

It is important to realise that legislation in the areas of payroll tax, workers compensation and compulsory superannuation attach ‘employer-like’ obligations to principals in common law independent contractor relationships. As a result, regulators with responsibility for enforcing this legislation are likely to continue an approach that looks beyond the agreement to the nature of the relationship in assessing whether the relationship comes within the scope of the legislation.

To learn more about how these important rulings may impact the engagement of contractors in your organisation, watch our on-demand webinar here. If you have any questions, please contact us or send us your enquiry here.

Disclaimer

The information in this publication is of a general nature and is not intended to address the circumstances of any particular individual or entity. Although we endeavour to provide accurate and timely information, we do not guarantee that the information in this article is accurate at the date it is received or that it will continue to be accurate in the future.

Published by: