The Research and Development Tax Incentive (R&D Tax Incentive) is a key lever used by the Federal Government to support innovation in Australia. The R&D Tax Incentive is jointly administered by the Office of Industry, Innovation and Science Australia (IISA) and the ATO, and can provide significant advantages for businesses undertaking R&D activities in Australia.

The R&D Tax Incentive is a tax offset, the rate of which has been coupled to corporate tax rates since 1 July 2021.

The R&D Tax Incentive currently provides the following offsets:

The aggregated turnover is the sum of the company’s annual turnover and the annual turnover of the company’s ‘connected’ and ‘affiliate’ companies around the world.

Control is a key factor for ‘connection’ – if either company controls the other, or both are controlled by the same third-party companies, they would be considered to be connected.

There is a looser threshold for ‘affiliation’ – any entity (other than a trust) that acts or could reasonably be expected to act in accordance with the company’s directions or wishes is considered to be ‘affiliated’.

The application of the tests for ‘connected’ and ‘affiliates’ can be challenging.

Where the tax offset exceeds the entity’s liability, the balance may be refunded or carried forward to be used in future income years.

Eligible R&D activities must be registered with IISA within 10 months of the income year in which they were carried on. The IISA registration number and relevant expenditures are lodged with the ATO as part of the income tax return for the year in which the expenses occurred.

A corporation that is any of the following may be an eligible R&D entity:

A consequence is that trusts, and some types of companies are not eligible.

If a company is a subsidiary member of a tax consolidated group, the R&D Tax Incentive applies to the consolidated group as if the head company is conducting all R&D activities, and only the head company should register for and claim the R&D Tax Incentive for the whole group.

The value of the tax offset available under the incentive is based on the expenditure on R&D activities. These activities include “core R&D activities” and “supporting R&D activities”.

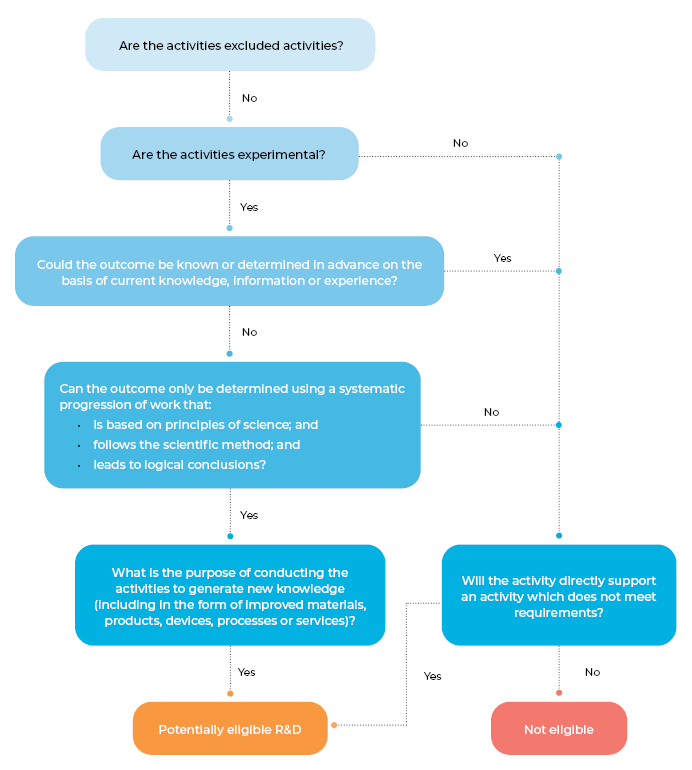

Core R&D activities are experimental activities whose outcome:

Supporting R&D activities are those activities which are ‘directly related’ to a core R&D activity.

Some activities are specifically excluded from being core R&D activities. However the activities could still be considered supporting R&D activities provided their dominant purpose is to support core R&D activities.

The decision tree sets out the key legislative requirements for activities to be either eligible core or supporting R&D activities.

R&D must generally be carried out in Australia to be eligible for the offset.

There are additional requirements that attach to overseas activities. For example, in order to be eligible, an overseas R&D activity must:

It may be possible to deduct expenses associated with R&D activities that are not linked closely enough to be considered supporting R&D activities – this could be expenditure such as consumables and software costs.

To deduct under the general deduction provisions, the expenditure must be both relevant and incidental to the production of assessable income, and not of a capital nature.

Additionally, there are separate deduction provisions for R&D deductions under section 73A of the Income Tax Assessment Act 1936, including for payments to approved research institute for related scientific research.

There are various additional measures surrounding the R&D offset, including:

A core reason for failure of R&D claims is inadequate documentation to substantiate that the legal requirements to claim the R&D Tax Incentive have been met. Records should be kept of all claimed activities, and the connections between related expenditure and the substantive activity.