25 June 2024

6 min read

#Construction, Infrastructure & Projects, #Environmental, Social and Governance (ESG), #Governance

Published by:

New financial disclosures relating to climate impacts will soon need to be made by large Australian companies from 1 January 2025. Large and medium-sized construction companies will be affected in a rolling scheme which will be in full force by 2028.

The Federal Government introduced the Treasury Laws Amendment (Financial Market Infrastructure and Other Measures) Bill 2024 (Bill) on 27 March 2024. Schedule 4 of the Bill sets out the new climate-related financial disclosure requirements.

Under the proposed legislation, publicly listed and large private companies (‘Chapter 2M’ reporting entities defined by the Corporations Act) that meet certain thresholds or have emissions reporting obligations under the existing National Greenhouse and Energy Reporting (NGER) scheme will be subject to the new reporting requirements.

The proposed law aims to enhance available market information by increasing financial disclosures in relation to climate change. According to the explanatory memorandum, the reporting requirements are designed to provide investors with access to comparable information about the entity’s exposure to, and management of, climate-related financial risks, allowing for greater transparency regarding those entities’ plans and strategies.

Further, the Treasury Department’s policy statement provides that “improving climate disclosures will support regulators to assess and manage systemic risks to the financial system as a result of climate change and efforts taken to mitigate its effects”.

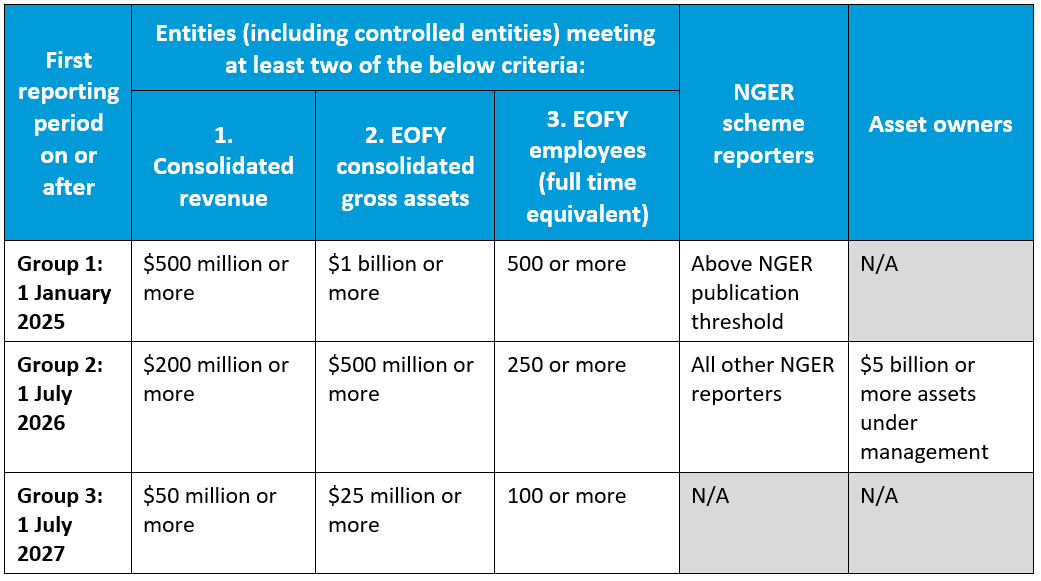

The sustainability reporting regime will be gradually introduced over a four-year period, starting with ‘Group 1’ entities on 1 January 2025. A Chapter 2M reporting entity (i.e. a large proprietary company, public company, disclosing entity, registered scheme, and registrable superannuation entity) that also meets two of the three specified criteria (see table below) will need to prepare sustainability reports and keep written records detailing its climate impacts, risks and opportunities.

Entities exempt from lodging financial reports under Chapter 2M of the Corporations Act and smaller businesses below the relevant threshold will not be subject to these reporting requirements.

Source: Treasury’s Mandatory climate-related financial disclosures – Policy position statement with amendments from the Bill introduced into Parliament

The annual sustainability report must contain the following information:

in accordance with the sustainability standards. The Australian Accounting Standards Board (AASB) have drafted three Australian Sustainability Reporting Standards (ASRS) in 2023.

Under the provisions of the Bill and AASB draft standards, the climate statement and accompanying notes must disclose information regarding the:

Material climate risks and opportunities are to be determined in accordance with the sustainability standards and are defined in ASRS 2 as potential negative and positive effects of climate change on an entity.

In a construction context, greenhouse emissions can be categorised as follows:

Construction companies generate scope 1, 2 and 3 greenhouse emissions, with scope 1 and 2 emissions generally produced at a similar extent to each other. However, the greenhouse emissions produced by construction companies will largely be scope 3 emissions due to the significant external materials needed for their projects.

Construction companies subject to the new reporting requirements need to know the emissions throughout their supply chain resulting from the production, use and transport of construction materials and energy consumption activities.

A director’s declaration must accompany the sustainability report confirming that the climate statement and notes are compliant with the Corporations Act and the relevant sustainability standards. This must be passed by a director’s resolution, dated and signed by the directors.

However, for the first three years of the regime, the director is only required to provide their opinion on whether the sustainability report is in accordance with the Corporations Act and that they have taken reasonable steps to ensure compliance.

Continuing the current financial reporting requirements under the Corporations Act, an entity will need to lodge a sustainability report with the Australian Securities and Investments Commission (ASIC) and provide a copy to its members who have made an election within three months after the end of the financial year. Entities that are not required to provide a sustainability report to members must make the report publicly available on its website, either on or on the day after it has been lodged with ASIC.

Limited liability will be given against individuals for making ‘protected statements’. These are statements concerning scope 3 emissions, climate scenario analysis or transition plans in sustainability reports within three years of the starting date.

Legal action will only occur in relation to those statements if the action:

Outside of these restrictions, usual assurance obligations apply under the Corporations Act regime in relation to director’s duties, the misleading or deceptive conduct regime in the Australian Consumer Law and general disclosure obligations. After the initial three-year grace period, any misleading disclosures could lead to both the company and directors facing civil legal liabilities.

Directors and officers of large to medium-sized construction companies should now review the reporting thresholds to determine whether they will be captured under the new regime.

The new reporting obligations under the proposed legislation interact with various sustainability standards and other Acts, making it essential to begin identifying a reporting entity’s climate risks and opportunities.

With the first group being phased in at the start of 2025, subject to the Bill receiving royal assent by December 2024, construction companies should track the progress of the proposed legislation and have processes in place for when the Bill becomes law. At the time of writing, the Bill has passed through the House of Representatives and will soon undergo its first reading speech in the Senate.

If you have any questions about the new reporting requirements or whether your company will be captured under the proposed legislation, please get in touch with our team below.

Disclaimer

The information in this article is of a general nature and is not intended to address the circumstances of any particular individual or entity. Although we endeavour to provide accurate and timely information, we do not guarantee that the information in this article is accurate at the date it is received or that it will continue to be accurate in the future.

Published by: