16 April 2024

4 min read

#Competition & Consumer Law, #Mergers and Acquisitions

Published by:

On 10 April 2024, the Federal Government announced significant changes to Australia’s merger regime through the release of their report, ‘Merger Reform: A Faster, Stronger and Simpler System for a More Competitive Economy’.

At the annual Bannerman Competition Lecture, Treasurer Jim Chalmers noted that that the proposed changes will make Australia’s merger approval system “faster, stronger, simpler, more targeted and more transparent”.

With the changes expected to commence on 1 January 2026, businesses should be aware of the changes as they pass through parliament and consider the potential effects on upcoming mergers and acquisitions.

We look at the key elements of the proposed changes to the merger regime below.

1. Mandatory notification regime and suspensory system

Australia’s current voluntary ‘informal’ notification regime will be removed as the new reforms will bring in a mandatory notification regime. Merger parties will be required to notify the Australian Competition and Consumer Commission (ACCC) about a proposed merger. The thresholds for notification will be prescribed following consultation on the proposed legislation but will likely include a monetary value threshold and a market concentration threshold. The ACCC may also collectively consider previous mergers undertaken by parties (within the last three years) when assessing whether a potential merger meets these notification thresholds.

Furthermore, mergers notified to the ACCC will be “suspended” unless approved by the ACCC regulator (or by the Australian Competition Tribunal following a review of an ACCC decision).

2. Public transparency of merger activity

The proposed changes also include the keeping of a public register of all ongoing and completed mergers and acquisitions for the purpose of promoting transparency, accountability and competition.

3. No right for Federal Court review

The new regime will make the ACCC the “expert first instance administrative decision-maker”, allowing them to determine whether a merger is likely to be anticompetitive.

Merger parties will not have the right to have a merger determined by the Federal Court, with the only right of review being a merits review in the Australian Competition Tribunal (which is consistent with the current review rights under the merger authorisation regime).

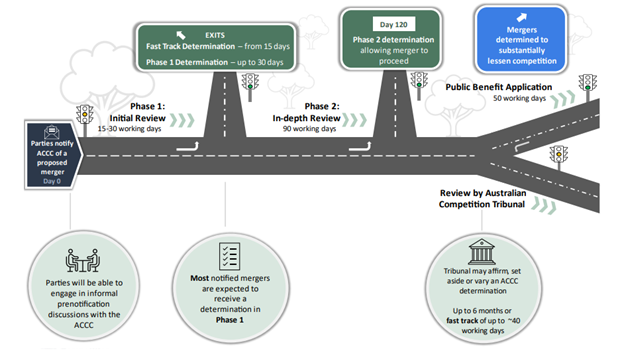

4. Merger review timeline

The reforms propose two phases of review:

Source: Treasury, ‘Merger Reform – A Faster, Stronger and Simpler System for a More Competitive Economy’ (10 April 2024) page 14

5. Substantive test changes

Under the new proposed test, the ACCC must permit a merger unless it reasonably believes that the merger would have the effect, or be likely to have the effect of substantially lessening competition in any market including (but not exclusively) if the merger creates, strengthens, or entrenches a position of substantial power in any market. (with the bold text indicating the changes from the current assessment).

The operation of this test will also be impacted by changes to the merger factors in section 50(3) of the Competition and Consumer Act 2010 (Cth) which may include:

6. Cost implications

All mergers subject to review will be charged “cost recovery fees”. These fees will be proportionate to the perceived complexity and risk of the merger. Treasury have projected that they are likely to range from $50,000 to $100,000.

7. No call in power

The ACCC had advocated for a so-called “call in power” which allows them to review mergers that fall under the notification thresholds. However, based on the current proposed reforms, this power will not be given to the ACCC.

The Australian Government is currently undertaking consultation with state governments, industry and other stakeholders. Further consultation on the draft legislation will take place in late 2024.

Treasury has announced that the reforms will commence on 1 January 2026, with a review of the legislation planned in 2029.

Given the significance of these reforms, we will continue to keep you informed of any significant changes that may occur.

How can we help?

Our team can assist you in understanding the new merger regime, staying up to date with any developments following the consultation process and providing advice that may address emerging issues. We also provide training to ensure your teams are aware of the latest changes to Australia’s merger regime and potential risks. If you have any questions, please get in touch with a member of our team below.

Disclaimer

The information in this article is of a general nature and is not intended to address the circumstances of any particular individual or entity. Although we endeavour to provide accurate and timely information, we do not guarantee that the information in this article is accurate at the date it is received or that it will continue to be accurate in the future.

Published by: