The Federal Budget for 2025-26 is unsurprisingly an election budget with some (modest) tax cuts for voters and no tax reforms. We highlight these changes below.

From 1 July 2026, the tax rate for the income threshold from $18,200 to $45,000 will be reduced from 16% to 15% and will fall to 14% from 1 July 2027. This will result in a tax cut of up to $268 from 1 July 2026 and $536 from 1 July 2027. These reductions apply to Australian residents only (and excludes foreign residents and working holidaymakers).

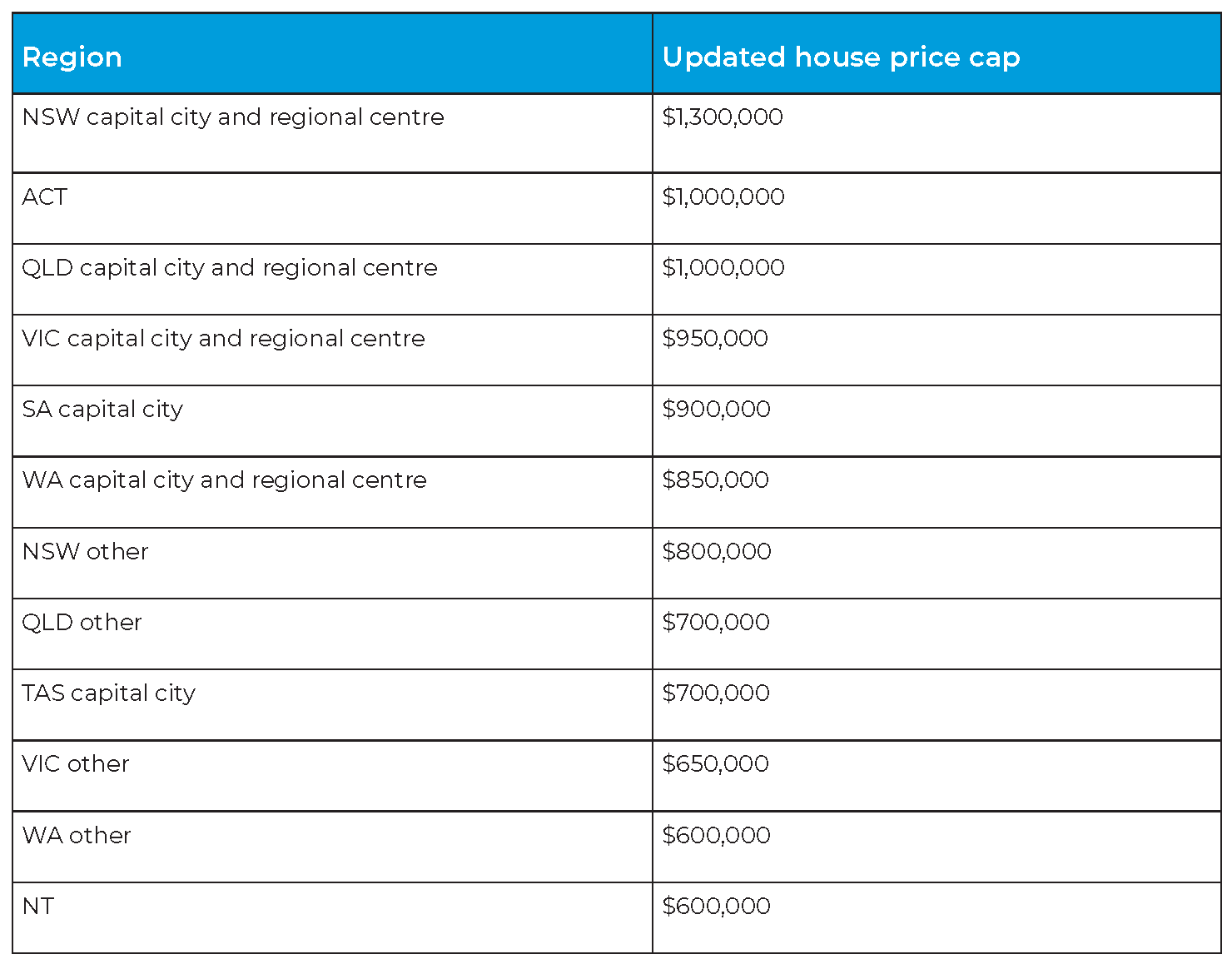

House price and income caps have been increased when accessing the government’s Help to Buy scheme (the government’s shared equity home scheme). Income caps will increase from $90,000 to $100,000 for individuals, and from $120,000 to $160,000 for joint applicants and single parents. We have tabled the updated house price caps below:

Meanwhile, the Australian Taxation Office (ATO) will receive funding to enforce the ban on foreign residents acquiring established Australian property for 2 years from 1 April 2025.

All outstanding HELP debts (before indexation on 1 June 2025 applies) will be reduced by 20% and the repayment schedule will be relaxed with marginal rates, and a higher minimum repayment threshold.

Energy bill rebates will be extended to the end of 2025 resulting in an additional $150 in grants to households and small businesses.

As a percentage of GDP, tax receipts are expected to decline to 23.5% in 2025-26 from 23.7% in 2024-25. Meanwhile gross debt is expected to increase to 35.5% of GDP in 2025-26, and peak at 37% of GDP in 2029-30.

On 7 March 2025, the ATO issued Taxpayer Alert TA 2025/1 targeting managed investment trust (MIT) structures that seek to inappropriately access the lower withholding tax rate of 15% (from 30%) on fund payments to foreign investors by engaging in uncommercial restructures.

In the budget papers, the government clarifies that it is not targeting MIT structures that are wholly owned by a single widely held foreign investor, such as pension funds.

Fund payments from 13 March 2025 will be subject to the amendments.

Previously announced measures to strengthen Australia’s foreign resident capital gains tax (CGT) regime will now take effect from the later of 1 October 2025 or the first 1 January, 1 April, 1 July, or 1 October after the amending legislation receives royal assent. The original start date for these measures were 1 July 2025.

These measures seek to:

The clean building MIT withholding tax concession measure has been deferred from its original start date of 1 July 2025 to the first 1 January, 1 April, 1 July, or 1 October after the Act receives royal assent. The concession would have extended the lower withholding tax rate to investments in data centres and warehouses.

If you would like further information on these changes, please contact our team below.

Disclaimer

The information in this article is of a general nature and is not intended to address the circumstances of any particular individual or entity. Although we endeavour to provide accurate and timely information, we do not guarantee that the information in this article is accurate at the date it is received or that it will continue to be accurate in the future.

Published by: