07 April 2020

4 min read

#Property, Planning & Development, #COVID-19

Published by:

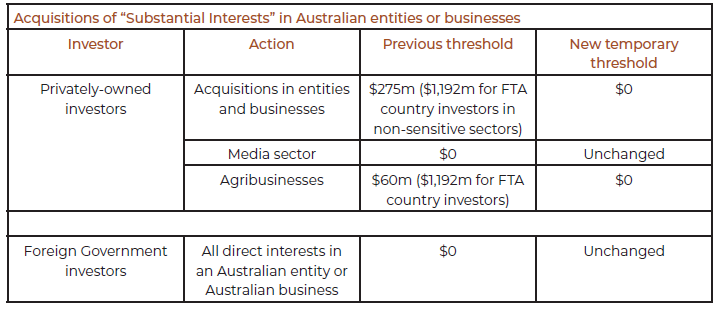

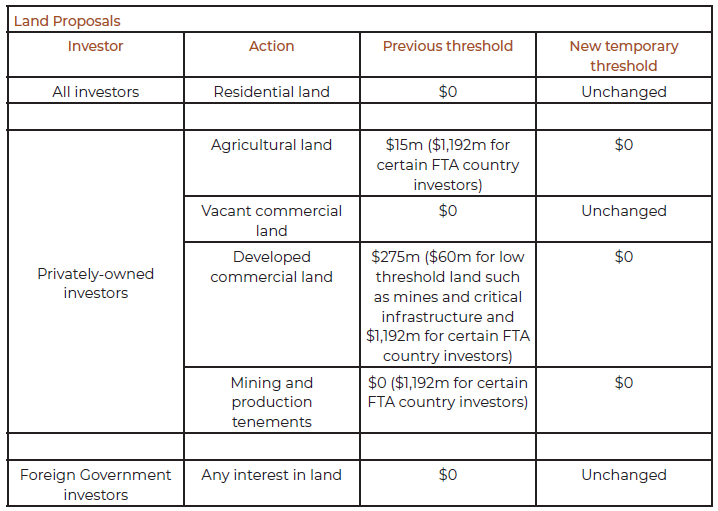

In this factsheet, we wrap-up these key changes and summarise the impact of the announced changes on acquisitions of "substantial interests" in Australian entities or business and on land proposals.

Latest news on FIRB changes

The key changes and latest information as at 3 April 2020:

Changes in details

Introduction

The Federal Treasurer has announced temporary changes to the foreign investment review framework to protect Australia’s national interest as the country deals with COVID-19. These changes are expected to remain in place for the duration of the COVID-19 crisis and will allow the Federal Government to safeguard the national interest by overseeing all relevant proposed investment proposals.

Lowering of monetary screening thresholds

As part of the temporary changes, the Treasurer has reduced the monetary screening thresholds to $0 for all foreign investment under the Foreign Acquisitions and Takeovers Act 1975 (Cth) (FATA).

This means that any:

by a foreign person, for the purposes of the FATA, will now require FIRB Approval.

Prior to these changes, a number of monetary thresholds were in place ranging from $0 to $1,192 million and were based on factors such as:

The impact of the announced changes can be summarised as follows:

The changes will apply to any agreement entered into after 10:30pm AEDT on 29 March 2020.

Statutory timeframe extended from 30 days to six months

The statutory timeframe for reviewing applications has been extended from 30 days to six months. This will apply to all new and existing applications. Foreign investors should now expect material delays in approvals, however, priority will be given to urgent applications for investments that directly protect and support Australian businesses and Australian jobs.

Exemptions

The changes will not affect transactions by foreign persons that are exempt from requiring FIRB Approval for a reason other than the application of a monetary threshold. For example:

Refunds for existing applications

The FIRB will consider refunding an applicant’s paid fee if the applicant decides to delay or deferits investment (and therefore withdraw its application) in response to the COVID-19 pandemic and associated economic conditions.

Next Steps

If you are a business or an individual and consider your business or yourself to be affected by COVID-19 and the legislation changes on a Federal and State level, please do not hesitate to contact us.

Authors: Vanya Lozzi & Elly Ashley

Disclaimer

The information in this publication is of a general nature and is not intended to address the circumstances of any particular individual or entity. Although we endeavour to provide accurate and timely information, we do not guarantee that the information in this newsletter is accurate at the date it is received or that it will continue to be accurate in the future.

Published by: