15 June 2022

8 min read

#Environmental, Social and Governance (ESG), #Corporate & Commercial Law, #Dispute Resolution & Litigation, #Planning, Environment & Sustainability

Published by:

By now, there’s a good chance that you’ve heard of the term ‘ESG’. However, like many others, you may be wondering what it is and why all the fuss? You aren’t alone.

According to a recent survey by SEC Newgate, most Australian consumers still don’t understand the ESG acronym. 30 per cent of the 1,200 Australians surveyed reported they had heard of ESG and only 8 per cent reported they had a good understanding.

In this article, we break down five things you need to know about ESG now, and why it’s time for many organisations to develop an ESG framework.

ESG is an umbrella term that stands for the “Environmental”, “Social” and “Governance” aspects of commercial activities. Broadly speaking, ESG can be utilised as a set of criteria (outside a traditional balance sheet analysis) by investors when evaluating risk in a company. Increasingly, investors are aligning investments with ESG values and capitalising on companies which actively address ESG risk through high ESG standards.

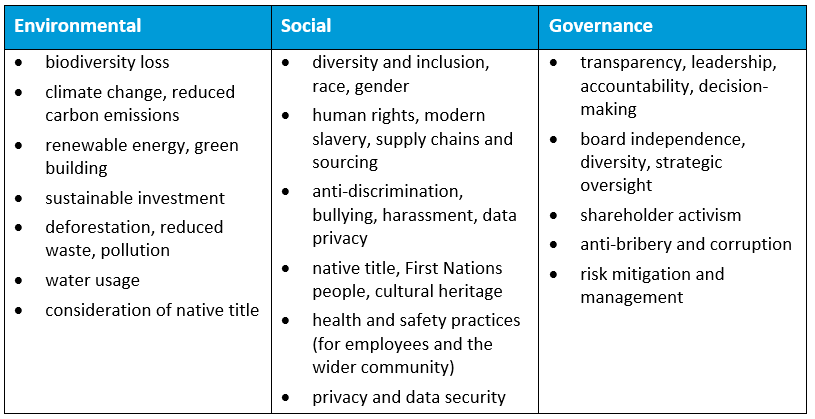

Environmental factors assess a company’s impact on the environment and vice versa. Social factors examine how a company manages stakeholder relationships, i.e. the rights and well-being of people both inside and outside of an organisation. Governance factors assess how a company governs itself. In other words:

How a company manages ESG can directly impact share price through reputational and litigation risk. Essentially, the ESG framework enables investors to assess how well a company performs on these metrics compared to its peers. In addition, principles of sustainable investment are used to compare data on ESG issues, which help investors determine if a company is worth the outlay.

Common ESG issues and areas of concern are:

Companies are facing more scrutiny in the corporate sector than ever before. Over the past decade, corporate social responsibility in Australia has shifted focus away from scandals and towards social and environmental citizenship.

Why? From an environmental perspective, the evidence in Australia is obvious. We are experiencing higher temperatures, fire seasons, extreme floods and droughts from climate change at an alarming rate. These events are also resulting in considerable reputational, economic and social damage.

Socially, movements like #MeToo and #BlackLivesMatter have exposed companies with insufficient policies in place to protect individuals from abuse, sexual harassment and racial discrimination. In addition, modern slavery reporting legislation, together with broader human rights due diligence reporting, is expected to increasingly impact companies with global supply chains and business relations.

ESG-conscious investing is one way to safeguard against future risk. Stakeholders are urging companies to integrate ESG goals into their business practices and value chain. In turn, they expect companies to be profitable and have measurable ESG strategies and reporting processes in place.

To keep up, lawyers and companies need to be aware of the key drivers:

Empirical studies have shown the business case for ESG investing is ‘very well founded’.[1] In Australia, the growth of ESG investment has tripled in the last three years. Last year, almost half of financial advisers used positive ESG-screening to find companies with high ESG credentials. A report by the Governance Institute of Australia stated that boards will need to retain diverse membership to lead change on ESG issues because doing so creates long-term value and success. Here’s why:

Interestingly, there was more climate change litigation per capita in Australia last year than anywhere else in the world.

With Australia becoming a jurisdiction for test cases, lawyers (in particular, in-house counsel) and companies who overlook ESG do so at their own risk.

On environmental considerations, while ASIC announced in March 2022 that it was conducting a review to determine whether managed investment and super funds promoted to offer ESG or ‘green’ products stacked up, APRA and industry-specific bodies were busy taking action by publishing guidelines on climate-related risk management (see for example, APRA Prudential Practice Guide: CPG 229 Climate Change Financial Risks).

Regulatory focus on the ‘S’ and ‘G’ space has been equally prominent. As we discussed in a recent case note, ASIC’s recent successful prosecution of RI Advice Group Pty Ltd for breaches of its financial services licence for failing to manage cyber security risks provides a timely example of the consequences of poor governance with respect to risk management. Further, at a time when there is increasing recognition that bullying, harassment and racism are clear ‘ESG’ failings, modern slavery due diligence, contracting labour and supply chains remain in full view of the workplace regulator, the Fair Work Ombudsman.

By global standards, Australia is late to the ESG party and Australian businesses risk being caught out, particularly when doing business in Europe. ESG concerns permeate all levels and divisions of an entity, from the top at a board level down to its supply chain and partners.

Leaders know that business survival depends on responding to change. Regulators are asking boards if their company’s disclosure on ESG issues and products accurately reflect current practice. For the reasons above, ESG is a priority for companies and their stakeholders.

Using an ESG framework can help directors, executives and their lawyers sustain economic growth and create a foundation for positive long-term results. Below are some steps your company can take to formulate its strategy and some things lawyers who advise them should be mindful of.

Companies

Lawyers

Our team of national experts can help manage your ESG risks and assist your business in setting up an ESG framework. In the coming weeks, we will be publishing a number of ESG case studies with key insights for businesses in various industry sectors, including audit, funds management, transport and agribusiness, as well as for in-house lawyers.

If you have any questions, please contact us below or get in touch with our team here.

[1] Gunner Friede et al, ‘ESG and financial performance: Aggregated evidence from more than 2000 empirical studies’ (2015) 5(4) Journal of Sustainable Finance & Investment pg 210; 212 (also cited in McKinsey Quarterly, ‘Five ways that ESG creates value’ (November 2019) pg 3).

Disclaimer

The information in this article is of a general nature and is not intended to address the circumstances of any particular individual or entity. Although we endeavour to provide accurate and timely information, we do not guarantee that the information in this article is accurate at the date it is received or that it will continue to be accurate in the future.

Published by: